About

ArcLight

ArcLight is a leading infrastructure investor with a long-standing focus on critical electrification infrastructure since its founding in 2001. ArcLight has owned over 65 GW of power and 47,000 miles of electric and gas transmission infrastructure, representing over $80 billion in enterprise value. ArcLight has a proven history of value-added investing across its core investment sectors including power, hydro, solar, wind, battery storage, electric transmission and natural gas transmission and storage infrastructure. ArcLight’s team employs an operationally intensive investment approach that benefits from its dedicated in-house strategic, technical, operational, and commercial specialists, as well as the firm’s ~2,000-person asset management partner.

We believe our extensive experience, deep domain expertise, and specialist resources enable us to source innovative transaction opportunities, deliver value-enhancing commercial and operational solutions, and unlock decarbonizing energy transition opportunities via asset re-positioning. Our strategic focus is on cash generative real assets positioned to capitalize on what we believe are the long-term industry tailwinds of electrification, decarbonization, and powering the digital economy.

Corporate Social Responsibility

Making a positive impact in our communities continues to be part of our approach to operating responsibly. Over the years, our Boston-based team has formed relationships with several local organizations that focus on addressing a variety of unmet needs in our communities. We have supported these organizations with time and resources and are proud of the long-lasting and personal relationships that have grown from our engagement. As part of that effort, both ArcLight and our employees provide time and capital to these important organizations:

Find the Cause Breast Cancer Foundation is on a mission to fund research into the environmental causes of breast cancer and educate the public about its prevention.

Pine Street Inn helps Boston’s homeless population move from the streets and shelters into a home. They also help the formerly homeless retain housing through street outreach, emergency services, supportive housing, job training, and employment connections.

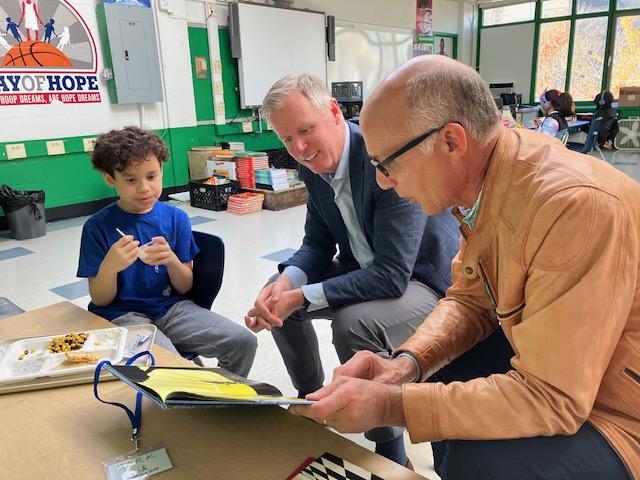

Read-to-a-Child believes every child deserves to have a caring adult read to them, and partners with community and corporate volunteers to make that happen. Readers share stories one-on-one with elementary students from under-resourced schools in Boston, Detroit, Hartford, Los Angeles and Miami.

Team IMPACT matches children facing serious illness and disability with college sports teams. Its goal is to guide children and teams in a mutually beneficial relationship of belonging, empowerment, and resilience, creating a long-term, life-changing experience for everyone involved.

Community Servings provides medically tailored, nutritious, scratch-made meals to chronically and critically ill individuals and their families.

Breakthrough T1D finances research devoted to curing, preventing, and treating type 1 diabetes (T1D). It advocates for government support of research and new therapies, ensures new therapies come to market and are recommended by healthcare providers, and helps connect and educate members of the T1D community.

The ESCALA Initiative provides women and other marginalized groups with access to business education and other forms of support. By helping people become profitable and self-sufficient entrepreneurs, ESCALA enables them to raise living standards for themselves and their communities.